Singapore

Singapore

Edited by: Huang Yu-Jung

From the minute we arrive on Earth till the moment we leave it, we are constantly seeking and shortening the distance to our dreams. We can choose to close our eyes and continue dreaming of unrealized fancies, or we can buckle up and fight to change the reality instead of learning to compromise. Even if we stumble and fall along the way, we still march towards the Promised Land.

Money, Money, Money: It’s a Rich Man’s World

As the human civilization develops, trading in currency has replaced bartering, while merchants and commoners also adapted by changing from fighting over territory to pursuing profits. Monetary profit has become synonymous with wealth and its importance cannot be overstated. In the Internet age of the 20th century, information become intertwined through connections and the Earth is once again transformed from round to flat, with the global currencies and markets intricately connected to one another.

In 2007, the subprime mortgage crisis caused the collapse of the first domino, triggering a series of financial crises that took the world by storm. Even the US could not stop the financial tsunami from erupting. As a result, housing prices plummeted, banks closed and the global stock market crashed. The mighty Wall Street operators lost their jobs in succession as the storm swept across the globe. Suddenly people started to panic and they were at a loss about the uncertainties of the future. Audrey Tan and Min Lee, who were at the Silicon Valley at the time, received their baptism by fire for the first time.

The world did not collapse, it just tilted a little bit but things are still different, with many tiny but clear changes in everyday life. For instance, young women holding their newborns began to appear outside the supermarket they often go to, and the sparkle in the eyes of their classmates at Stanford University became dimmer. People the same age as them had no choice but to bear the burden of their families’ livelihood, doctors or attorneys were entangled in financial crises due to their lavish consumption behavior. They witnessed the impact of economy on people’s lives and felt the weight of money in life.

Although money isn't everything, without money you have nothing. Money is an issue that we have to be faced with eventually in life, albeit the scope it encompasses is too broad to explain in a clear and precise manner. Therefore, it is a subject the schools and home education tend to avoid or simply brush upon, as if children will naturally know how to handle money when they grow up.

“When we were faced with the financial tsunami in the US, we realized the importance of financial management for young people. In retrospect, we suddenly discovered that we were only taught the most fundamental concept about money management like savings and controlling expenses, and that’s it.” Curious about money management, Audrey Tan and Min Lee started questioning everyone around them, only surprised to find out that this was not only their problem but also the problem of many other young people. Consequently, the two girls began to contemplate what transformation they could introduce for the society and for the next generation. In 2010, they co-founded PlayMoolah.

Early Start: Developing Good Financial Habits from Games

In 2008, Tan and Lee ingeniously incorporated five concepts of money including income, spending, savings, investment and donation based on B.J. Fogg’s Behavioral Model on Persuasive Design to design the Moolahverse game prototype. The player is the manager of a planet, where income in the form of gold coins is earned from adorable aliens by offering them catering or medical care services. Then the player can use the gold to purchase houses so that aliens awaiting immigration on the spaceship can have a place to stay. The player can also head to the shopping center to decorate their planet with mountains, clouds, flowers, trees, fountains and small animals. One can even change the color and shape of the planet to create their ideal planet that suits their own whims.

As the player levels up, the types of meals and medical care services they are able to provide become diverse; with more complex meals and medical care, the rewards earned correspondingly increases. In the early stages of the game, the player only has a stock of 10 basic food ingredients and medicines. As aliens shop in the store, stocks will be depleted so the player will need to replenish the stock by purchasing medicines or ingredients in order to keep offering their services. The process ingeniously leads the players to understand the concept of operating cost.

Upon entering the target laboratory, Planet God will question the player if there is something they want or if they have an objective they wish to accomplish. Next, the God will share with the child that the secret to making dreams come true is through saving money every day. The player can see what other players’ dreams are and plant the seeds of hope for their own savings, learning or talent according to their needs. Taking savings as example, Planet God will ask the player to enter their target objective and the reason for it and select the specific target item or set an amount. The player will be guided to enter a daily savings amount and the system will automatically calculate and display the number of savings days needed. The aim is to encourage the user to begin saving in order to successfully achieve their dream. Afterwards, the player can return to the target laboratory to enter the amount they saved where the God will congratulate you and suggest saving the money in a piggybank or handing it to your parents for safekeeping.

Subsequently, they also released multiple new games such as Coin Catcher and Yusheng Rush, so that the children can learn about needs and wants during the process of catching coins. In the time-limited supermarket shopping activity, the user will learn how to control the restaurant’s operating cost by selecting equal quality but cheaper ingredients, in turn making education fun. For young adults or fresh graduates, they also designed the life simulation game “WhyMoolah” to guide the players to make major decisions in life such as getting married, having children, buying a car or house etc., where they will learn how to consider hidden expenses, control their budget and establish the correct attitude toward money management. The young people can also sign up for the monthly Honesty Circle, where they practice sharing and talk about their money spending situation under guidance in order to create a good relationship with other members and money. Furthermore, they can also cultivate habits that will benefit their lives in the long run.

Playmoolah currently has over 10,000 players worldwide, and it has collaborated with several commercial banks in Singapore such as DBS and OCBC Bank to license the game software to these financial institutions to facilitate their promotion of money management concepts to future potential clients. In September 2013, the founders Audrey Tan and Min Lee both received the Young Women Innovators Award from APEC and WEF.

When Halo Rings Moon or Sun, Rain's Approaching on the Run

Each first encounter or even the tiniest change will give us opportunity to become someone different with entirely different future and more magnificent dreams. When Min Lee was studying at the Victoria Junior College, a teacher once said, “We teach students to become familiar with the world but not themselves.” Therefore, the graduation tour of the year was a little unconventional, because she and 19 other students traveled to the Silicon Valley to visit corporations including Apple. However, it was the visit to The Delancey Street Foundation that completely changed her knowledge about the world in the past.

Before arriving at The Delancey Street Foundation, Min Lee was reluctant to meet rapists, drug addicts and strangers. However, everything surprised her when she exited the bus, as she was greeted with verdant lawn and fragrant flowers. The members supported and enlightened one another, and the ambiance permeated with the aura of culture instead of crime. Suddenly, her perception broadened “In the past, I always thought doing business is selling your passion, but this trip offered me a very different perspective about the world, I was able to see that doing business can also contribute to the society and create values – making money is more than just about bringing in the dollars.”

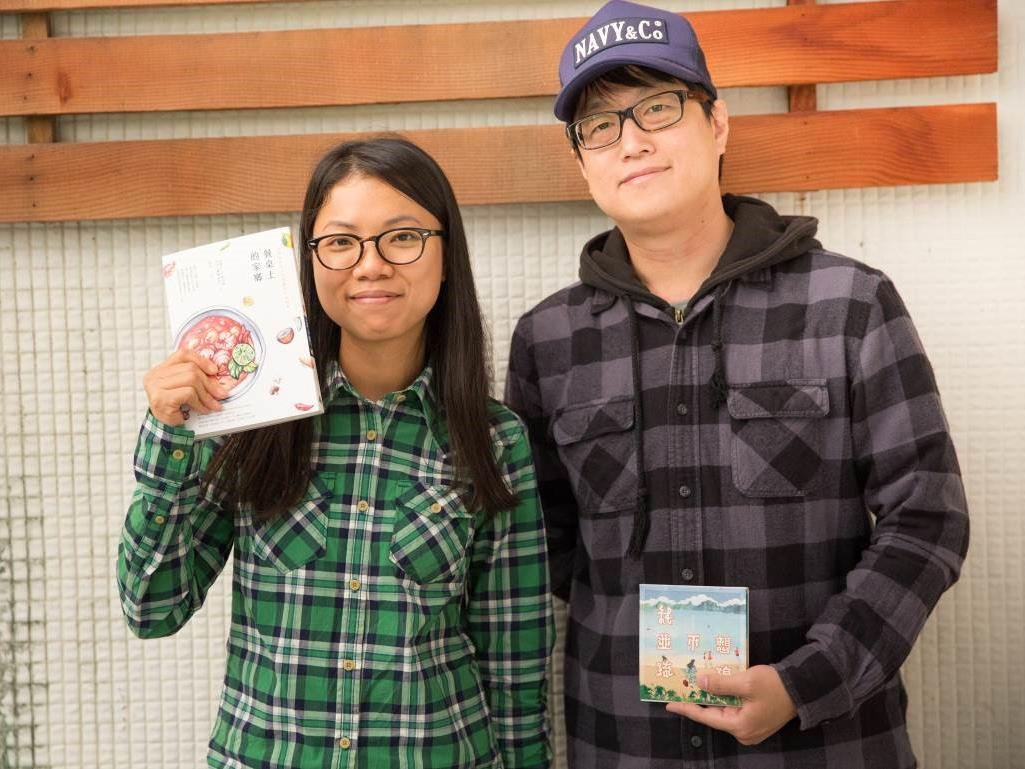

Later, when Min Lee applied for the National University of Singapore’s student exchange program as an intern to Qik, she met Audrey Tan again. As a result, two optimistic girls from National University of Singapore who are both passionate about the education of the next generation and underprivileged communities soon evolved from roommates to best friends. During the financial tsunami, she and Audrey Tan witnessed the dramatic impact of the economy on people’s lives and suddenly everything became clear: the past and the present are interconnected and the present is bound to influence the future as well. Consequently, she and Audrey Tan further developed into business partners to fill in the blanks in their lives. “Our dream is to see financial management discussions emerge in families, we want to make it a positive and intimate topic,” says Audrey Tan with a smile during the interview.

If you don’t know how to manage money, you will never achieve wealth. Audrey Tan and Min Lee discovered that money management is very similar to health management but is very different from regular learning. The two essential lessons in life can only bear fruit through knowledge and practice over the long term. However, since they cannot be achieved overnight to see instant results, the lessons are often easily neglected. In order to overcome the impasse, they aspire to endow everyone with a healthy concept about money and money management habit; they also firmly believe that as long as one genuinely wants to accomplish something, the whole world will come to your assistance.

Butterflies are attracted to blooming blossoms, thus one, two, three like-minded partners joined the playmoolah team to brainstorm with them. Every day, their eyes gleam with hope, contemplating how to develop innovative games that will make money management simpler and more interesting. In doing so, they can help more people to naturally come in touch with financial management and planning via a happy, fun process and exert a subtle influence on their economic concept, thereby making learning how to manage money an integral part of their lives. Money is no longer a shackle that keeps us stranded; rather it becomes a cornerstone for helping people to materialize their dreams and goals. Perhaps the ripple started by the two Singaporean girls will slowly propagate globally, ensuring that people will no longer be devastated by the financial storm in the future. Are you ready to make small changes to your habits?

1B.J. Fogg: The first scientist to articulate the concept of "captology," a word he coined to describe the overlap between persuasion and computers. He later founded the Stanford Persuasive Technology Lab and published the book “Persuasive Technology: Using Computers to Change What We Think and Do” in 2003. He is currently still dedicated to researching how tiny habits can create a lifelong behavioral model.

2Yusheng: a quintessential Chinese New Year’s dish in Malaysia and Singapore and often the first course served in reunion dinners. The main ingredients are sashimi, shredded cabbage, celery, carrot, ginger and crushed peanuts etc. The sauce is mixed from plum paste, orange juice and syrup. Each time an ingredient is added, people will say something auspicious in order to imbue hopes for the New Year in the dish. When everyone is seated around the dining table, they all mix up the ingredients with their chopsticks while saying auspicious words to bring good luck, prosperity and fortune for the New Year to come. Yusheng is not only shared among family members, friends can also enjoy the dish too.

Reference:

http://yourstory.com/2014/01/singapore-based-playmoolah/

http://www.canon.com.sg/thinkbig/playmoolah-making-serious-business-fun-part-1/

http://www.canon.com.sg/thinkbig/playmoolah-making-serious-business-fun-part_2/

http://business.asiaone.com/news/money-not-enough-playmoolah-co-founder

http://www.asianentrepreneur.org/audrey-tan-lee-min-xuan-founders-of-playmoolah/

https://www.youtube.com/watch?v=-uUQUQ_t_hw

This work is licensed under a Creative Commons Attribution-NoDerivatives 4.0 International License.

Please attribute this article to “Workforce Development Agency, Ministry Of Labor”.